Commentary elsewhere in the sector suggests that management was right. As I wrote in July, management continued to support those hopes. But they were hoping for a second-half recovery in data center.

Investors didn’t expect Gaming revenue to bounce back this year after the crypto bust. One analyst called NVDA the best play on that optimism, and moved his price target to a Street-high $251.Īdvanced Micro Devices (NASDAQ: AMD) too sounded positive on its third-quarter call, though AMD has managed to get a big win, adding Alphabet (NASDAQ: GOOG,NASDAQ: GOOGL). Intel stock has rallied sharply off earnings, thanks in part to optimism toward renewed demand in data center. But the category still was a significant driver of Nvidia’s growth - and perhaps the most significant now that crypto demand has returned to more modest levels.Īnd the news here seems good, at least looking at the rivals in the data center space. They accounted for barely one-fourth of total revenue in the first half. The cause has been an apparent “pause” in demand, as rival Intel (NASDAQ: INTC) told investors earlier this year.ĭata center sales aren’t as important as those in the Gaming category (which includes crypto-related revenue).

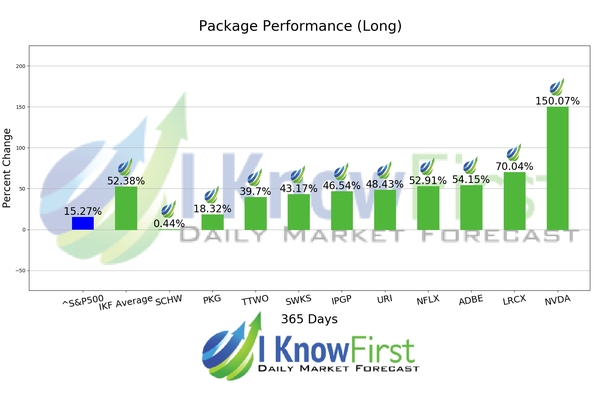

In the first half of FY20, however, data center revenue has declined 12% year-over-year, per the 10-Q. But one of the less-covered aspects of Nvidia’s recent struggles has been a slowdown in the company’s data center business.īetween fiscal 2017 and fiscal 2019, Nvidia’s data center revenue grew a staggering 253%, according to figures in its Securities and Exchange Commission Form 10-K. The effect of the crypto bust has been a focus of many headlines surrounding Nvidia stock. And that suggests that Nvidia stock, despite those valuation concerns, can continue to rise. The second half of 2019, at least so far, is going almost exactly to plan. That said, the gains in NVDA stock make some sense - and could continue.ħ Under-the-Radar Retail Stocks to Buy NowĪs I wrote back in March, Nvidia stock was a second half story. That earnings release looks potentially risky given the obviously building expectations. I understand those concerns, particularly with Nvidia earnings on tap next week.

0 kommentar(er)

0 kommentar(er)